Can central banks get their act together on the climate crisis?

The last few weeks have seen a rush of central banks – under pressure from both activists and their own research – taking steps to limit their climate impacts. These moves have been cautious and come after two years where central banks have funneled billions in cheap money into the economy with little consideration of climate implications. The strangest thing about this is the authoritative case as to why this is a bad idea made by the central banks themselves.

The role central banks can play

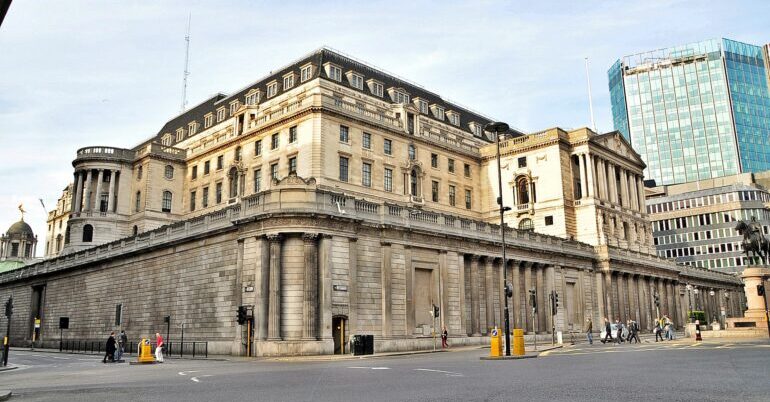

Central banks have only relatively recently become a focus of climate advocacy. This is to a large extent the result of the work of academics such as Ulrich Volz and campaigners groups including Reclaim Finance and Positive Money. However, it has been turbocharged by the work of central banks themselves. In particular the work of the Bank of England (BOE) under Mark Carney, who as early as 2015 was warning about the systemic risk of climate change and unburnable assets. Groups have been formed such as the Network for Greening the Financial system (NGFS), and have produced authoritative reports that highlight both the scale of the climate challenge for central banks, but also calls on them to act.

It does this by drawing on information within the narrow mandates of central banks. While the mandates of the groups involved in NGFS vary generally they are responsible for overseeing the financial system and ensuring it’s stability. Many central banks also target inflation and a couple have additional mandates related to supporting government policy objectives. A more limited number are explicitly mandated to tackle sustainability considerations. This is on the increase, with the BOE joining their number in March 2021.

A proliferation of reports from central banks and the NGFS have highlighted how climate change posses a threat to financial stability. These threats to stability come though the physical effects of the devastation climate disasters would impose on the real economy. The 2019 NGFS Comprehensive report suggests it could cost 17% of the world assets. This is referred to as physical risk.

The other risk consistently highlighted is transition risk. Transitioning to tackle climate change requires at a minimum complete restructuring of our industrial and energy basis. This process risks leaving stranded assets and useless infrastructure, exposing investors in the sector to massive losses. This has been highlighted by the fossil fuel divestment movement for years and we are already seeing it materialise with the precipitous decline in coal devastating lagging utilities worldwide. Some would argue this transition requires a complete rethinking of our entire economic model, but central banks are not willing to consider that, yet.

These reports and advocacy efforts, by almost all central banks make the slightly backwards case that climate change threatens our way of life, therefore also the financial markets and thus central banks should take action. In a rational world, the financial markets section of that argument would be superfluous.

What can central banks do?

Central Banks have a range of tools at their disposal that have been identified as tackling climate change. To give a non-exhaustive list, ranging from the most to least radical:

- Climate stress tests. Transition and physical risks affect the value of assets. Stress tests – modelled off the tests used to examine exposure if loans go bad – look at how exposed financial institutions are to a range of climate scenarios. 18 Central Banks are set to run these this year.

- Creating a clear, coherent and regulated taxonomy of green and brown investments.

- Adjusting reserve requirements of assets that banks need to hold to reflect climate risk. Some reports indicate the Bank of Lebanon may have done this.

- Refusing to extend credit to or accept as collateral assets that are either highly exposed to climate risk or contributing to climate disaster.

- Changing their own asset purchases to reflect climate considerations. One of the reasons that central bank portfolios are so carbon intensive is that they are ‘market neutral‘. This means that they purchase based on the bond market average and based on debt rating. Due to incumbency and historical profitability many carbon intensive producers have high credit ratings and thus are well considered bond purchases and due to the travails of the sector they are issuing a lot of debt.

- Direct lending for sustainability considerations. A couple of banks notably the Bank of Japan have started doing this on a very small scale as has the Bank of China.

- Banning fossil fuel investments.

Words then inaction?

Having identified possibly belatedly that their house was on fire and tools to put it out. Some might expect central banks to act with the scale and speed needed, particularly when they themselves have made such a case for action. However, as an excellent Positive Money report from earlier this year put it central banks’ “actions aren’t living up to their words”. The report highlights the extent to which central banks have identified the fire, and how they are contributing the blaze, then kept on pilling on kindling.

Indeed, it is worse than that. Since the NGFS inaugural report some readers may be aware there has been a global pandemic. Central Banks responded to this by relaxing capital requirements and on a mass scale suspending activities such as climate stress tests and injections of capital into the economy (the European Central Bank (ECB) has grown its balance sheet by around 40% or approximately $2 trillion). Various reports, including by central banks have highlighted how these actions have supported carbon intensive sectors. In the case of the ECB, 63% of some programmes went to high emitters. Central Banks did not just keep piling on kindling, they accelerated the rate they were doing so.

In the last few months, central banks worried about inflation have begun to look for ways to wind down their asset purchase programmes as they have come under pressure from activists taking increasingly dramatic action, including flying into their offices. These include both the ECB‘s and the BOE‘s commitment to consider climate in future asset purchases and gradually divest from fossil fuel investments. Meanwhile the Federal Reserve, the world’s major monetary actor, continues to claim that the responsibility lies with other parts of the government.

Given the scale of the challenge and the recognition of it, these steps appear insufficient, particularly following a year when central banks have doubled down on what they admit are destructive practices. To take one area, the recent Fossil Fuel Exit strategy report highlighted that we need no more investment in fossil fuels and massive investment in renewables. The conservative International Energy Agency mostly concurred, arguing coal needed to be closed down and no new oil and gas was needed. No central Bank has come close to accepting this.

PS. We hope you enjoyed this article. Bright Green has got big plans for the future to publish many more articles like this. You can help make that happen. Please donate to Bright Green now.

Image credit: Eluveitie – Creative Commons

This topic has been discussed in detail by a working group of the Policy Committee of the Scottish Greens. There will be a policy motion on this topic being presented to the Scottish Greens conference in October. While the article discusses the problem I feel it does not go far enough in addressing the solutions (to turn banks from the financiers of the climate emergency to providing the capital for a green transition). Nor does it look at the social justice element of addressing climate transition risk. When the working group looked at this in detail we felt that there needed to be protection for individuals and small businesses from the banking crisis triggered by the climate transition risk highlighted in the article. This is why we are calling for the creation of a Financial Health Service to work in tandem with the greening of banking.