We need a Financial Health Service to provide financial security from cradle to grave

When we have the next banking crisis, what should we do?

From the experience of the last banking crisis, we have a reasonable idea of what the other parties would do. Labour would bail out the banks while the Liberal Democrats and Conservatives would get the poorest and most vulnerable to pay for it. However the likelihood is that none of these parties have a plan for the next banking crisis.

We know a banking crisis is coming. This is well documented and the reasons for it were described by Sam Alston in a recent article for Bright Green. We have probably left it too late to have a smooth transition from a fossil fuel economy to a net-zero economy. So as the waters begin to rise and the forest fires burn, we are looking at a sudden transition rather than a smooth one. A transition where the fossil fuel economy needs to be shutdown immediately and the assets associated with it become worthless overnight. This type of sudden transition could trigger a banking crisis in those banks that have financed the fossil fuel economy or are holding fossil fuel securities as part of their capital. This is known as “climate transition risk”.

So, what would you do?

In 2008 when the Banking Crisis hit, banks like RBS and Lloyds needed to be bailed out. If they had been allowed to fail this would mean none of us would be able to get our money out of our accounts. As Alastair Darling said “we were two hours from the cashpoints running dry”. However, if you had got your cash out of the cashpoint before the banking crisis, that money would still have value as the Bank of England could not go bust. Indeed, across the Eurozone during the first Covid-19 lockdown there was widespread withdrawal of cash as there was a fear of a banking crisis.

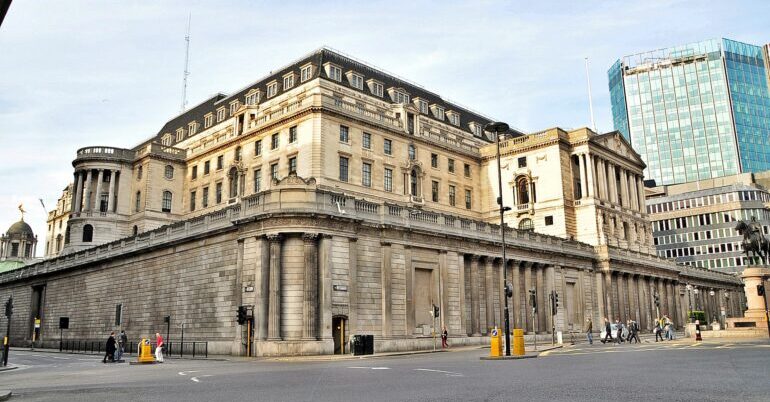

However, in our digital age the idea of reverting to cash is not an option (trying shopping online with cash). So, the solution is an electronic currency which is available to everyone but does not rely on commercial banks. The Bank of England is currently looking at introducing such a currency (a Central Bank Digital Currency which is often referred to as “Britcoin”). It is consulting with the banks rather than the people. So, the likelihood is we will end up with a banker’s currency designed by the banks for the banks.

As part of our financial services motion to the Scottish Greens conference, we propose doing something different. We propose introducing a Financial Health Service to provide financial security from cradle to grave. This would include a Universal Basic Account which would be available to every person that qualifies for Universal Basic Income (which would include asylum seekers and refugees as well as citizens).

This bank account would be an account in central bank money (like electronic cash) and held with the Bank of England (or Scottish Central Bank if Scotland were independent).

- It would be connected to the payments system to allow money to be transferred into and out of the account.

- It will be possible to have wages paid directly into a Universal Bank Account and to pay bills from a Universal Bank Account.

- It would be possible to withdraw cash from a Universal Bank Account.

However, there would also be a money management aspect to the Financial Health Service to help keep people out of debt. For example, there would be no overdraft offered from a Universal Bank Account. It would be possible for an account holder to block payments for gambling or alcohol from the account.

As everyone would have a Universal Bank Account they could be opened for pupils while they were still at school. This would allow financial lessons could be given to teenagers so that they have knowledge of how to operate a Universal Bank Account before they left school and went on to work or further education. Indeed, one of the features of a Universal Bank Account is that it would be linked to the UBI system. So, people would have an account based on their identity, removing the requirement for a permanent address. This would mean that these accounts would continue to be available for people who were homeless or in temporary accommodation. Meaning we could continue to reach people as part of a national financial inclusion exercise.

Returning to the question posed at the start of the article: if there was a banking crisis, what would you do? Under our proposals, many people could carry on as normal. Government backed Universal Bank Accounts would be insulated from commercial bank failures. They would still hold value. So, if the commercial banks failed, we would be able to carry on using cashpoints to withdraw money from our Universal Bank Accounts. There would be no need to bail out any failing banks. Any money held by citizens could be transferred to their Universal Bank Account. Any restructuring of the failed banks could then take place over the following weeks and months without the whole economy grinding to a halt because a few greedy bankers had ignored the climate emergency.

PS. We hope you enjoyed this article. Bright Green has got big plans for the future to publish many more articles like this. You can help make that happen. Please donate to Bright Green now.

Image credit: Eluvietie – Creative Commons

Leave a Reply