What would Green central banking look like?

The path to net zero runs through the City of London.

We can all cycle more, insulate our homes, replace gas boilers with heat pumps but if the financial services continue to invest in the fossil fuel industry, we are going to miss all our net zero targets. The proposed Cambo oil field is just the latest example. It would not being going ahead without investment from the financial services industry. UK banks such as HSBC, Barclays and Standard Chartered are among the many banks that fund or advise Shell – which has a 30% stake in the project.

Sadly, the Cambo oilfield is just a small part of the annual investment by the financial services industry in fossil fuels. Between 2018 and 2020, the five biggest UK banks invested over £40 billion in the coal industry, with total investment in the fossil fuel industry estimated to be running at around $60 billion a year.

These sorts of investment figures are clearly not sustainable if we are going to reduce global warming to anything close to 1.5o C. As a result many of the protests around COP26 have focused on defunding climate chaos and many influential activists have spoken about the need to stop the financial services industry from continuing to invest in the fossil fuel industry.

As a party of government in Scotland, protest is not enough. We also need to offer alternative policies to the unrestrained capitalism that is destroying out planet. To this end in November 2020 the Policy Committee of the Scottish Green Party set-up a working group to develop the policies necessary to ‘defund climate chaos’. This working group produced a policy motion which was approved unanimously at the Scottish Greens conference in October 2021. The focus of this motion was to stop the financial services sector investing our money in the fossil fuel industry and instead use that money to finance a green transition of our economy.

Banks usually look at a short term investment horizon which is typically around 2-3 years. This short-term thinking is what has caused the climate emergency and the ongoing environmental crisis. We need to invest for the long term, invest in a sustainable way, invest in an economy for future generations not the next banker’s bonus.

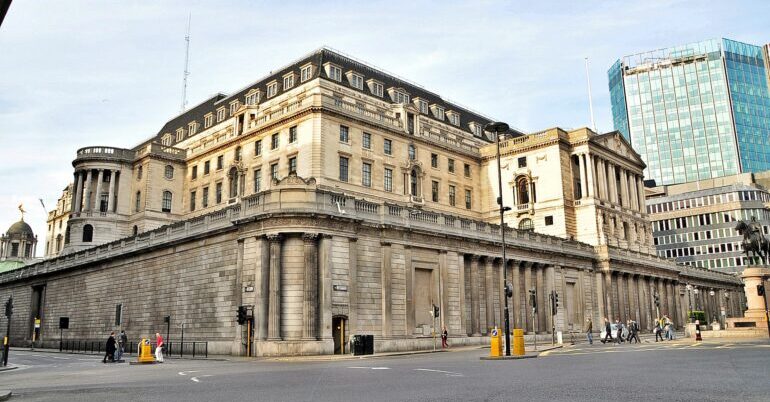

The Bank of England has a green mandate to resolve these issues but expects to achieve this while conducting business as usual, focusing on the “financial risks” to the economy rather than actual change. If we leave it to the banks to decide when it is in their interest to stop investing in fossil fuels, we will never achieve the changes required in the short timeframe available, a far stronger approach is required.

When banks lend, they create money. However, this creation of money is subject to regulatory control by the Bank of England. While this regulatory control has been strengthened in recent years in response to the banking crisis, the measures taken do little to tackle the climate emergency.

The main control is that banks are sufficiently capitalised. This means that they have sufficient reserves in case of a banking crisis caused by loans not being repaid or the housing market crashing. While the Bank of England has controls regarding what can be included in this capital, these are based on the financial value and financial risk associated with the assets. Under current rules, there is little thought given to the risks from the climate emergency or the environmental impact of these investments. Instead we should ensure that any capital held is not invested in industries that are destroying our planet by mandating capital and investment rules that align with a green transition of the economy.

Our new Financial Services Policy makes a series of proposals to transform financial services investment to meet these green transition objectives.

The policy calls for central banks (whether it is the Bank of England or a Scottish Central Bank in the event of independence) to:

- Ensure that any assets held by a central bank are consistent with a science-based transition pathway to net-zero.

- Introduce a “green supporting factor” or a “brown penalty factor” to recognise the impact of climate risk on lending and investment. So, banks are penalised for investing in the fossil fuel industry.

- Amend their collateral framework to ensure that capital held by banks to support their lending reflects the risks associated with climate change. This would limit the central bank’s own exposure to climate risks and would decrease the market value of various carbon intensive assets – helping to re-align capital to support sustainability.

The financial services sector is global in nature. For this reason, we support international moves to promote sustainable banking. Our policy calls on the financial services industry to be aligned with Article 2.1c of the Paris Agreement, and with the United Nations Sustainable Development Goals. This would be achieved through the financial services sector aligning their strategies, activities, and operations with the UN Principles for Responsible Banking.

Like all Green parties, the Scottish Greens feel that the climate emergency should be treated as an emergency in the same way that the Covid-19 pandemic was. We should use all the tools at our disposal to combat the climate emergency. So, our new policy supports the use of monetary financing, quantitative easing, and any other central bank tools that are necessary to combat the climate emergency and finance a green transition of the economy. The money is there, it is just being used for the wrong purpose.

PS. We hope you enjoyed this article. Bright Green has got big plans for the future to publish many more articles like this. You can help make that happen. Please donate to Bright Green now.

Image credit: Eluveitie – Creative Commons

Leave a Reply