Why oil giants are making record profits and what we can do about it

It tells you something about the questioner if when confronted with someone with an extraordinary amount of wealth they ask how they came into possession of it, or what they intend to do with it. In the case of the oil majors’ profits, the answer to both questions seems to be the same: efficient destruction of our world. This leads to two more questions equally telling about the questioner: Why, and can they be stopped?

Extortionary profits

You may recall 2020, when it seemed that big oil firms had both had a karmic crash and seen the errors of their ways. Annual reports and billboards were full of protestations of oil majors’ desire to invest in renewable energy, carbon capture and efforts to lower their carbon footprint. Oil price and gas prices touching record lows ensured that firms slashed dividends, planned investment and payrolls. BP predicted peak oil demand in 2019. Carbon Tracker, the IMF and the Bank of England warned of the risk of stranded assets, as firms invested in fields that would never make a profit.

In 2023 the six largest Western oil firms all set record profits totalling £223bn. The state owned equivalents have yet to announce their end of year results, but the largest of them Saudi Amerco made £48.4bn in Q2 alone. The only major player that may buck this trend is Gazprom of Russia struggling under equipment shortages and unfavourable geopolitics. These same geopolitics forced BP and Total to take £32bn of losses, which makes their profits of £27bn even more remarkable.

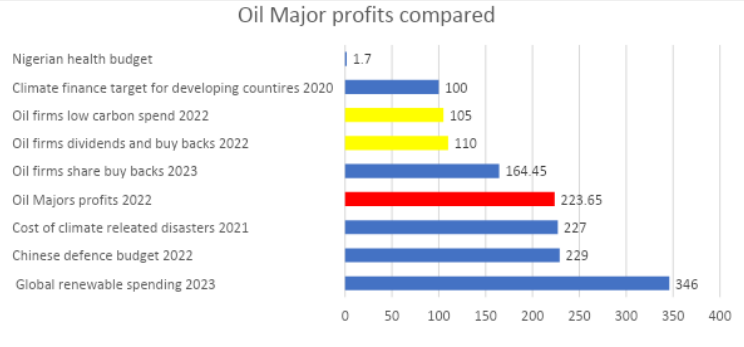

Profits on this scale are hard to comprehend. To help, Figure 1 shows the profits relative to a couple of useful figures. It is nearly equivalent to the Chinese defence budget and, spookily, the cost of climate related disasters in 2021 likely partially driven by oil development. It makes Nigeria’s – one of the world’s most oil rich countries – health budget look like chicken feed, raising concern both about profit drain and the choices of Nigeria’s leaders. As world leaders weigh loss and damage funds for global south countries suffering the effects of Climate Change, big oil could fill the unmet aid with less than half its returns.

A key figure is that oil major profits are equivalent to 60% of global renewable spending – a figure that is just 30% of what Bloomberg NEF estimate is needed to reach net zero by 2050. Oil firms can only find approximately $105 billion for low carbon investments up to 2030, less than half their annual profits in 2023.

How did they get this windfall?

Unsurprisingly these profits are mostly derived from producing, selling and refining oil and gas commodities. London Brent oil went from $51.64 on 1 January 2021, almost tripling in 2022 before settling at a still high $85 in January 2023. The factors that caused this price surge are primarily outside of firm’s control. This was in short a unexpected windfall, the equivalent of miners stumbling upon a seam of gold. They could all have forgone profits (as the UN secretary general called on them to do) and produced at below market price, as the French government forced it’s nuclear operator to do, but this could have had unpredictable market effects and may not have prevented shortages.

This is not to say that firms discovered this merely by innocently fulfilling their primary function. The price rise driving poverty and economic distress globally could have been averted, by a planned and rapid transition to renewable energy. Oil majors lobbied against, this throwing their muscle into climate delay and denial.

What are they going to do with the windfall?

Based on the rhetoric of western oil majors in 2020 you might of thought the profits would be invested in energy transition. However IEA analysis showed the industry allocated just 5% of its capital in low carbon projects in 2021

Much of the profit is going back to shareholders. Figure 1 shows that oil majors have announced $110bn in dividends and buy backs in 2022. To clarify the direction of travel, Exxon and Chevron alone have already committed to $125bn in buy backs by the end of 2024. Since those who own these firms’ shares are rich, while we all need to buy oil this represents a transfer of money and power to the worlds richest groups.

Some of the rest of the profit is flowing to renewables. BP announced $8bn more for low carbon investment. However, it committed $8bn more to oil and gas at the same time and announced plans to pump more oil for longer. This is reflected across the sector, Shell froze its renewable division, Exxon scrapped it’s investment in algae, which it pledged was going to power stuff (how was never very clear). The largest of them all Saudi Aramco had never even bothered with a renewables division. Most concerningly of all, in 2021 and the first half of 2022, oil majors committed $85 billion to new oil and gas, setting the world on the path to a catastrophic 2.5C of warming.

Why?

On the same day Shell made its announcement, the IEA landmark energy forecast suggested 85% of new generating capacity worldwide would be renewable though to 2025. Oil firms may be rolling in more cash than Chinese generals, but the way they are using it suggests they are doubling down on a losing hand. Oil demand is falling as renewables, electric vehicles and climate action shrink the market in the medium term.

Oil firms are of course aware of this. The doubling down on oil and fossil gas, could merely reflect a new confidence. As mentioned above, their push to renewables was lukewarm at best. The sector still has $30 trillion worth of assets exposed to climate risk. It may be flush with profits and a new narrative around the hydrocarbon sector can shed attempts to take on a green hue and redouble its efforts to resist climate action that threatens it’s balance sheet.

There is a further incentive. At points in the past twenty years, Shell (2020) and BP (2006) have made moves towards energy transition by, for example, scaling down shareholder returns and expanding nascent renewable energy divisions. These have been met with share price falls, directly impacting on management bonuses. Renewables never will be as profitable as oil due to a number of structural reasons: the barriers to entry are lower and there is price cannibalisation of profits. Exxon, who has rarely bothered to pretend anything other than extreme prejudice towards efforts to preserve human civilisation has been rewarded with healthy shareholder returns. Saudi Aramco floated the largest ever IPO in 2020.

In the medium term, climate change represents a major risk to the oil industry. However, oil firms are dominated by hedge funds and asset managers chasing short term returns. If the planet burns, it is only a minor factor on next month’s quarterly report.

What can be done to stop them ?

In 2011, Carbon Tracker’s landmark Unburnable Carbon report outlined that less than 20% of the world’s carbon reserves could be burnt to ensure that we stay within our allocated Carbon Budget. In 2021, the IEA called for no new oil and gas. Oil firms are now charging with increasingly little restraint in the other direction.

There are Bond villains whose plans for their use of their comically large fortunes are less destructive than the plans that oil majors have announced in 2023.

James Bond being fictional, other approaches to preventing this may need to come forward. For the past decade, major shareholders such as the Church of England have attempted to rein in oil majors’ activities that endanger life on earth. They scored notable victories, including forcing BP and Shell to expand their renewables in the first place. However their approach now appears, if not to have failed, to have been majorly set back. This could turbo-charge the divestment movement that aims to deprive these groups with the capital, social licence and professional services they need. It sets the stage for increasing escalation of ongoing conflict between the hydro-carbon industry, climate and land activists. It will also increase pressure on governments to confiscate these firms’ capital and thus their power to continue driving us into a bleak future.

That this is a familiar tune does not make the song less true, and with the oil reports of 2023 it rings out all the clearer. Oil firms have set a course that will temporarily drive up their share price at the cost of wrecking us all. The question is will they be allowed to keep their hands on the tiller to keep steering?

PS. We hope you enjoyed this article. Bright Green has got big plans for the future to publish many more articles like this. You can help make that happen. Please donate to Bright Green now donate to Bright Green now.

Image credit: Carol Highsmith – Creative Commons

Leave a Reply